Definitions

Funding and Fundraising – Terms and Examples

FUNDING

What does Philanthropy mean?

“Philanthropy is defined as the act of giving money, goods, time or effort to support a charitable cause, usually over an extended period of time and in regard to a defined objective” (Source: Philanthropy Ireland – Make Your Mark Report, Jan 2020)

Definitions of philanthropy are often debated, with differing views on what distinguishes it from other types of charitable giving. However, it generally refers to institutional, large-scale giving, which can take the form of Major Gifts, Trust and Foundation grants, endowments, and legacies or bequests. In Ireland, philanthropy is less developed compared to other countries like the USA and UK, where it is more prevalent.

When we discuss philanthropy, we are referring to a type of charitable giving. All philanthropy can be considered ‘giving’, though not all giving would be ‘philanthropy’.

What is the definition of Fundraising?

We define fundraising as the act of collecting donations or contributions from individuals, businesses, or other organisations for a specific cause or purpose. It is an essential means of generating income to directly support the missions and programmes of social impact organisations. While philanthropy tends to relate to the donor, fundraising is associated with an organisation or individual that is soliciting and receiving the gift. Philanthropic gifts are usually solicited through fundraising.

What is a funding model?

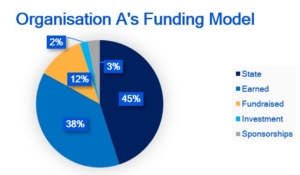

A funding model is a structured approach to building a reliable revenue base that supports an organization’s core programs and services. Nonprofit organisations or charities may use various income streams to establish a sustainable funding model that enables them to achieve their mission and goals.

A funding model is different from a ‘fundraising mix,’ which refers to an organisation’s breakdown of fundraised income by method.

Example of Funding Model

State Income

Any income from government agencies and public bodies. Income from the State may come in the form of grants, service contracts, support schemes and proceeds from national lottery income. We include income from the European Union in this category.

Earned Income

This is revenue earned through provision of a service or good, which is paid for by clients. This income tends to be generated by the organisation’s mission-related activities. Examples of earned income in a nonprofit or social impact context include tickets to a sporting event or theatre production, tuition and annual membership fees.

We distinguish ‘earned income’ from the fundraising method of ‘selling something’ in more detail below.

Fundraised Income

A source of income that is generated specifically for an organisation’s mission. This is typically income donated by individuals, corporations, or other organisations (e.g., trusts or foundations). Fundraised income differs from earned income in that it is generated separately from, rather than through an organisation’s key activities.

See below for more details on the various Fundraised income methods.

Investment Income

This is the return on a sum invested or an investment that has reached maturity and is released back to the organisation’s account. Examples include bank interest and appreciation on assets. Investment income is a relatively underdeveloped revenue source for social impact organisations, with significant potential.

FUNDRAISED INCOME

Methods of Fundraised Income (Fundraising Mix)

Major gifts

These are typically a once-off gift donated by an individual/family. Many organisations classify a donation of €5,000 and above as a major gift. A gift from a Corporate Donor, however, is categorized as a ‘corporate donation’ – see below. Likewise, a large donation from another organization is often classified as ‘trust and foundation’ income. Finally, legacies/bequests are classified separately as ‘major gifts’. Like these other methods, though, major giving is a key means of strategic, relationship-based fundraising. Major giving is considered an example of philanthropy.

Regular/Committed Giving

When individuals have set up a regular payment to a charity or nonprofit eg a Direct debit to an International aid organisation. Collections are made at a pre-defined time eg weekly/monthly. This method is a relationship based fundraising strategy.

Corporate Donations

Corporate donations may vary broadly and appear similar to other methods, such as major giving and regular/committed giving. However, Corporate Donations are given by a business entity or company. Corporate giving includes cash donations (e.g., a payroll donation* matching scheme) in-kind donations (e.g., a company donates computers to a school), or skilled volunteering (e.g., the same company sends employees to teach coding to students at the school). This method forms part of relationship based fundraising strategies. Corporate giving is an evolving and increasingly popular method.

*Payroll donations may be considered either regular/committed or corporate giving, usually depending on who facilitates/directs the donation. E.g., a payroll donation scheme managed by the company on behalf of its employees can be considered corporate giving.

Direct Marketing Appeals/Campaigns

These once-off requests for support are usually online/direct mail campaigns (as well as TV and radio ads) and are focused on an element of the service or benefit the organisation delivers. As the name suggests, DM appeals and campaigns are targeted fundraising initiatives occurring during a specified timeframe. E.g., RTE’s Late Late Toy Show Appeal with The Community Foundation for Ireland in 2022 or Alone’s ‘Share the Warmth’ campaign.

Emergency Direct Marketing Appeals/Campaigns

These are urgent, dedicated appeals which address needs arising from a crisis. E.g., Syrian Earthquake relief, Ukrainian war relief efforts. These are typically online, direct mail, TV and/or radio appeals which are short-term and may be once off.

Local/Community Fundraising

These are local initiatives and events championed by community members to raise funds for local or national charities. Typically, they are volunteer based. Returns can vary depending on event/initiative. Examples include a charity pub quiz, benefit gala, or marathon for charity. Larger examples of local/community fundraising include Pieta’s Darkness into Light event or Irish Cancer Society’s Relay for Life. Some local/community fundraisers may overlap with DM Appeals/campaigns/selling something to some degree (e.g. Daffodil Day).

Selling Something

When an organisation sells items specifically to generate income for the organisation e.g. honesty chocolate box in hair salons. This is different from earned revenue, which is generated through the organisation’s core activities.

Example: a community theatre selling tickets to its shows would classify those sales as earned income. This is because the theatre’s mission is to produce and put on plays to enrich the public. That same theatre holds a bake sale specifically to raise money to purchase new costumes for its youth acting programme. This is considered ‘selling something’.

Other examples include the sale of Daffodil Day merchandise, raffle tickets, or charity shop income.

Trusts and Foundation income

Trusts and foundations are philanthropic organisations or structures set up to support and fundraise for particular causes. They may then distribute those funds in the form of grants to organisations who address that cause, e.g. the Children’s Health Foundation. Other trusts and foundations are ‘operational’, and administer the funds raised to further their own mission-related activities. Trusts and foundations have unique and sometimes complex structures which vary from country to country. Ireland’s trust and foundation landscape is comparatively underdeveloped but growing.

When referring to trust and foundation income, we usually mean grants coming from endowed funds or donor advised funds.

Legacies

These are planned gifts made by someone in their will, to be donated after they have died. These can be substantial and can have a significant impact on the recipient organisation. Legacies are also referred to as bequests.

Endowments

An endowment is a permanent fund that is created by an organization or individual to support a specific purpose, such as a charitable or educational cause. The endowment fund is invested, and the income generated from the investments is used to support the designated purpose over the long term. E.g., the Trinity College Endowment Fund, which combines alumni funds to support research and scholarship in Trinity.

Tax Relief from Donations

All donations over €250 and below €1 million in Ireland are eligible for tax relief to be claimed by the charity/nonprofit recipient. At present, the donor cannot avail of this relief.